Update – 21/05/2020

May 21, 2020

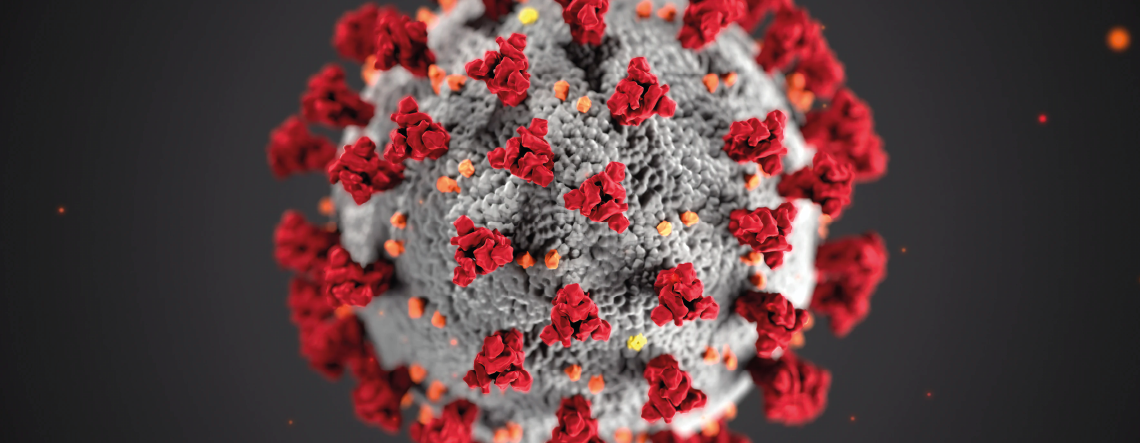

As of the latest update by the Greek authorities yesterday evening, the total number of confirmed Covid-19 diagnosed cases in Greece is 2,850. One new death was announced, bringing the death toll to 166. The number of patients treated in intensive care units stands at 22, while 96 people have left the intensive care unit.

Prime Minister announced yesterday an extension of the government program to support businesses through July and targeted tax cuts, as part of a plan to revive tourism and other sectors hit by the coronavirus pandemic. The tax cuts include lowering the VAT in public transport fares, open-air cinema ticket prices, coffee and non-alcoholic beverages to 13 percent from 24 percent from June 1 until October 31.

The government will also subsidise the salaries and social security contributions for workers in the tourism sector and will pay unemployment benefits to seasonal employees who will not be hired this year.

The prime minister also announced that the tourism season will officially begin on June 15 and international flights on July 1.

TOURISM

GOVERNMENTAL SUPPORT MEASURES

1. Expansion of a measure to put workers’ contracts under suspension, payment of a compensation and covering social insurance contributions (in the sectors of tourism, restaurant, transport, culture and sports).

2. A new mechanism to support short-term employment is created to preserve job positions and support business activity.

3. Offering unemployment benefit to seasonal workers who will be employed during this tourist season, along with subsidizing social insurance contributions for seasonal pert-time workers.

4. Suspension of payment of debt tranches to the tax agency for all enterprises which remain closed, along with the sectors of tourism, restaurant, transport, culture and sports, for June.

5. Expanding a measure for 40% reduction of rent payments in June for all enterprises remain closed, along with the sectors of tourism, restaurant, culture and sports. This measure also applies to individuals for their primary residence and to students.

6. For real estate owners, leasing their assets to enterprises and workers hit by the crisis, a suspension of tax payments is offered.

7. Enterprises will be offered a second round of refundable advance payment.

8. The government is offering a reduction of advance tax payments for 2020 and 2021 to enterprises hit by the crisis.

9. Reducing VAT on transports from 24% to 13% in the period June 1-October 31, 2020.

10. Reducing VAT on coffee and beverage drinks from 24% to 13% for the period June 1-October 31, 2020.

11. Reducing VAT on tourist packages from 80/20 to 90/10 for the period June 1-October 31, 2020.

12. Reducing VAT on cinema tickets from 24% to 13% for the period June 1-October 31, 2020.

13. Tax deduction of spending on scientific and technological research.

14. Creation of a National Registry of Start-up Businesses.

15. Creation of a program that will subsidize primary residence borrowers hit by the pandemic.